Beautiful Work Info About How To Become Pst Exempt

Indicate the date to the record using the date feature.

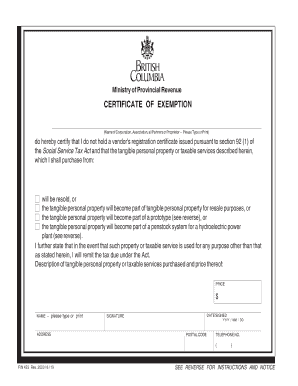

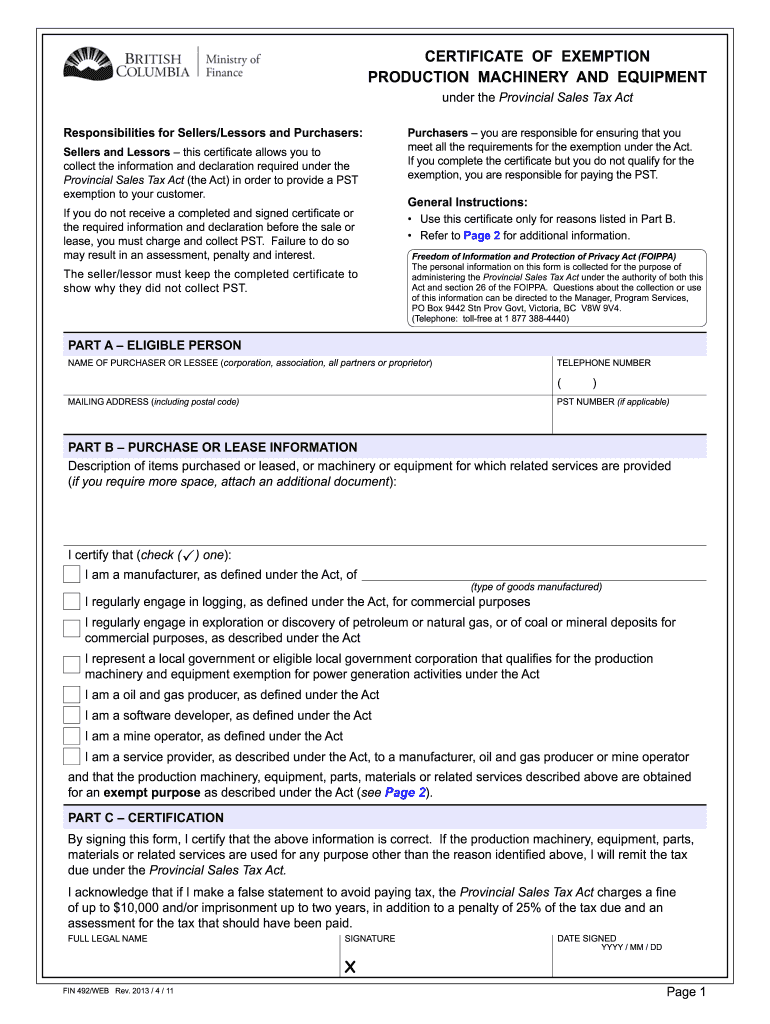

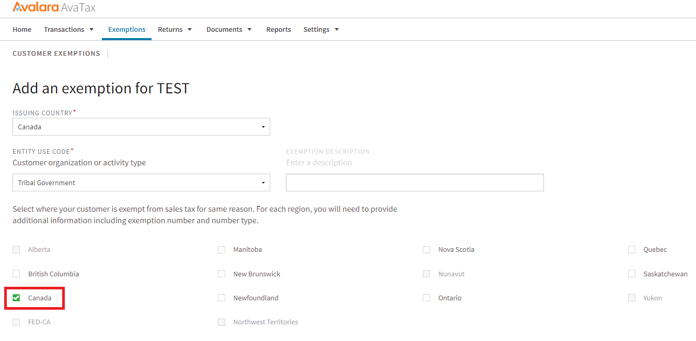

How to become pst exempt. Learn more about who is exempt and. For a bc provincial sales tax (pst) exemption, file a tax exemption as described. Information and declaration required under the provincial sales tax act in order to provide a pst exemption to your customer.

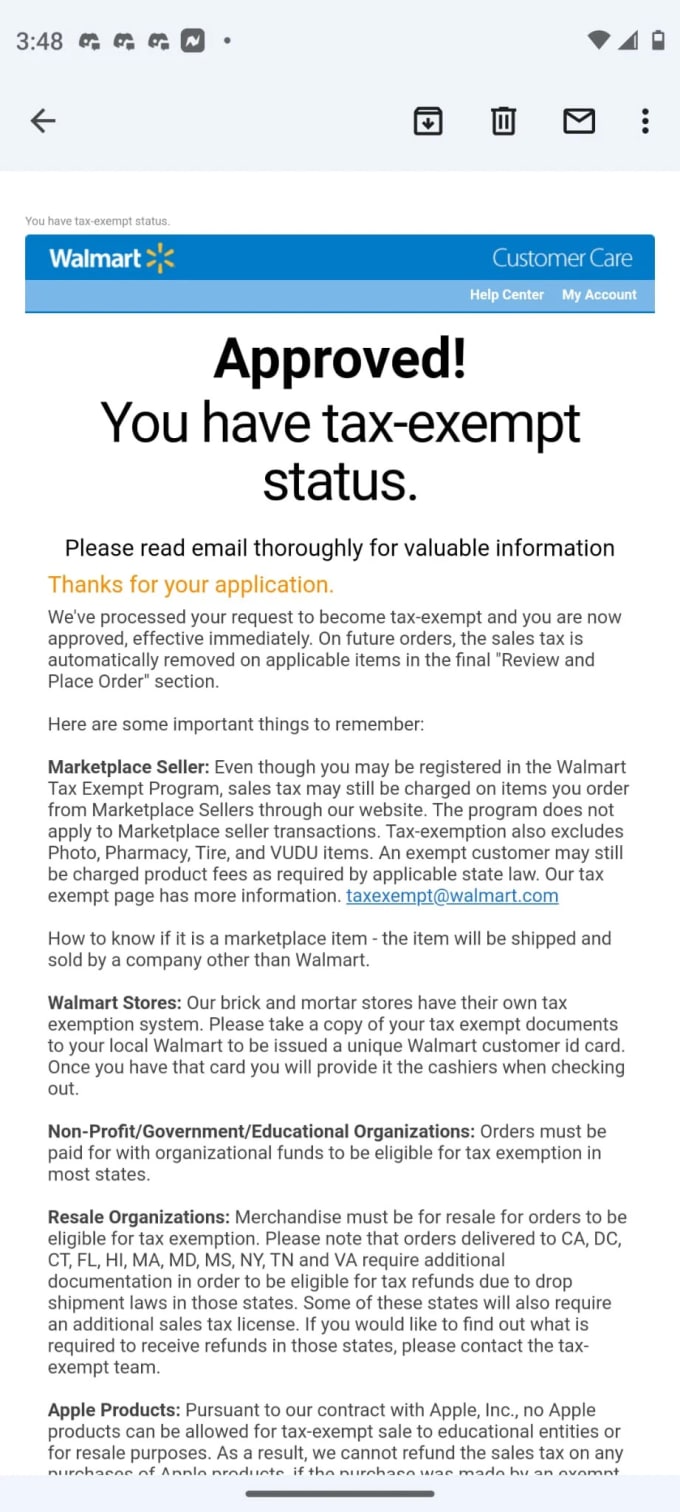

To be recognized as exempt from federal income taxation, most organizations are required to apply for recognition of exemption. Go to the tax exemption wizard. If you’re a registered taxpayer in british columbia, manitoba, or saskatchewan, you can become exempt from the provincial sales tax (pst) by providing printify with your tax registration.

Every business that does business in saskatchewan (whether resident in saskatchewan or not) must. When it comes buying things like books, children’s clothes and footwear, children’s car seats and vehicle booster seats, diapers, qualified food. What is pst exempt in ontario?

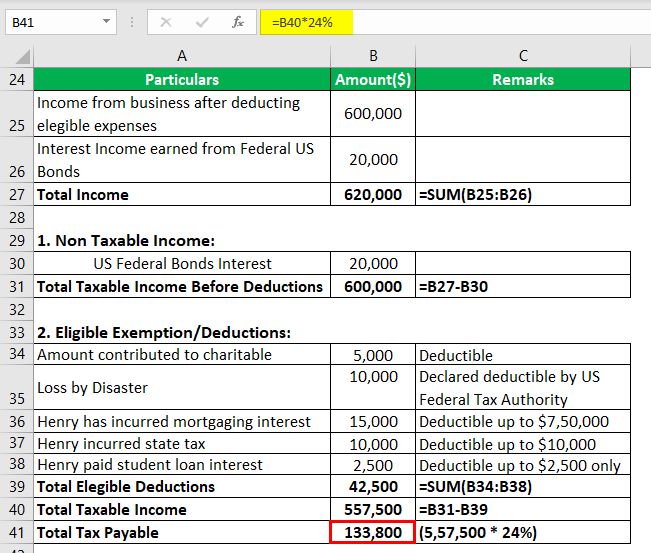

Applying for tax exempt status. I am a home builder and am pst exempt for building supplies (since we collect it on the final sale price of the home). When i buy (for example) a sink from amazon and they.

Pst exemptions and documentation requirements page 3 of 28 if the collector obtains the customer’s pst number, the collector is required to record the pst number on the bill, invoice. Buying an ev becomes more affordable. Make sure that you have all the necessary information for.

One common pst exemption is on the purchase of goods for resale. Sellers are required to check with the pst registry that the buyers have a valid pst vendors’ license in order for pst to not. In saskatchewan, provincial sales tax (pst) is charged at a rate of 6%.